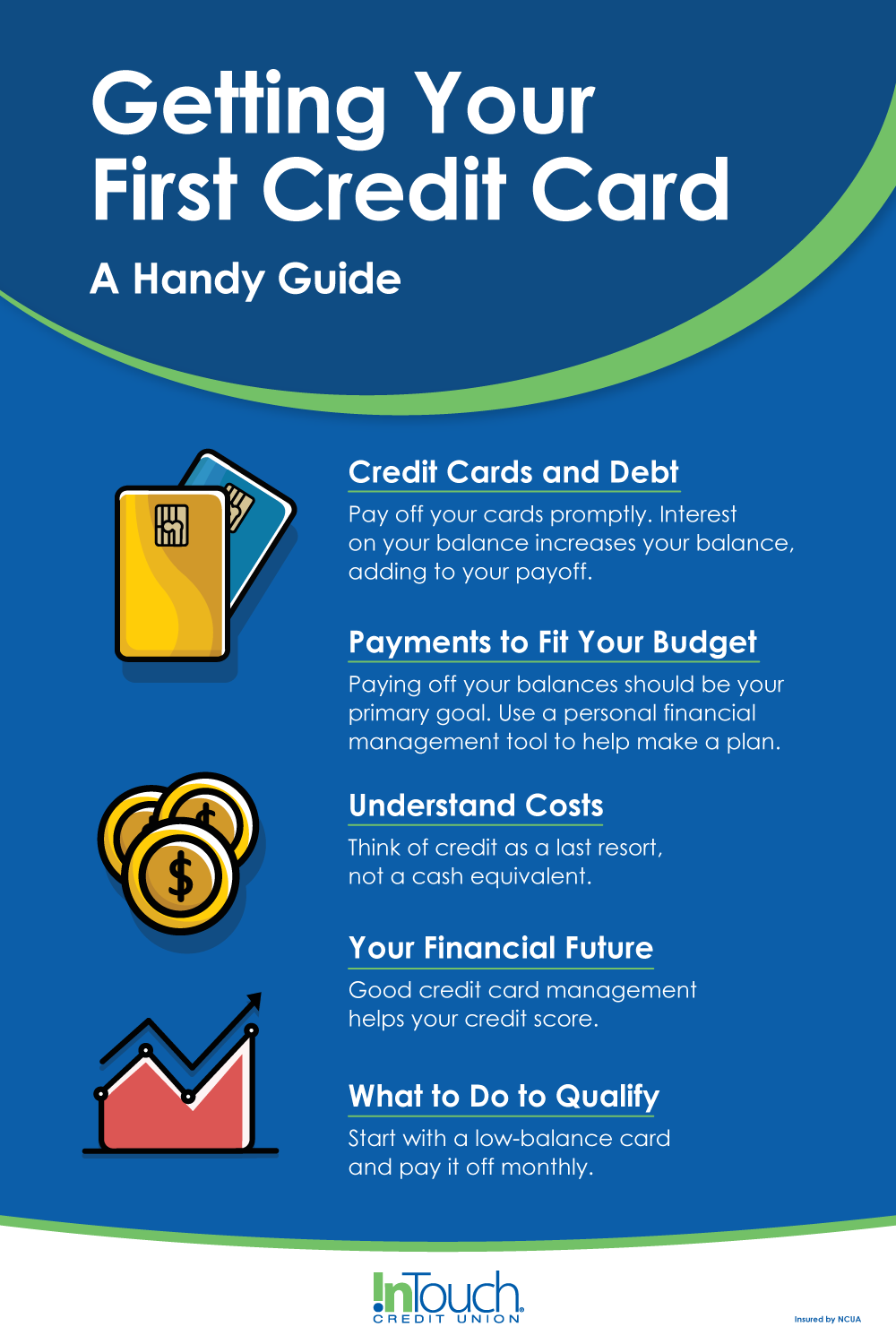

Unique Tips About How To Apply For Your First Credit Card

![How To Get Your First Credit Card [Infographic]](https://i.ytimg.com/vi/F7vE2zp2EO8/maxresdefault.jpg)

Applying for a credit card online is convenient and you can get a.

How to apply for your first credit card. However, being eligible does not mean you are guaranteed a credit card. For new and outstanding balance transfers after the introductory period and all purchases, the variable apr. Regardless of how high your credit card apr is, you don’t have to pay a dime of interest as long.

Find a card with features you want. Ad start building your credit history while earning rewards for everyday purchases. Some credit card issuers clearly state the minimum score required before they’ll even consider your application.

With a secured card, you’re required to deposit a. To apply for a credit card, you should first familiarize yourself with the application process. There are multiple ways to complete a credit card application:

The database itself is managed on behalf of first tech federal credit union by ultimate software group, inc, 2000 ultimate way, weston, fl 33326. While credit card applications may vary depending on the issuer, be prepared to provide your personal information—things like your social security. You must make a deposit with the lender, usually equal to the credit limit on the account.

Consider the benefits, perks, interest rates and features that may come with the. Once you're ready to apply for a credit card, review the credit issuer's website to learn about your options for applying online. Apply for credit card will sometimes glitch and take you a long time to try different solutions.

Ad our fast & secure online application is the first step on your journey to building credit. The credit card application process breaks down into a few basic steps: $0 intro for the first year, then $95.

![How To Get Your First Credit Card [Infographic]](https://infographicjournal.com/wp-content/uploads/2021/11/First-Credit-Card.png)